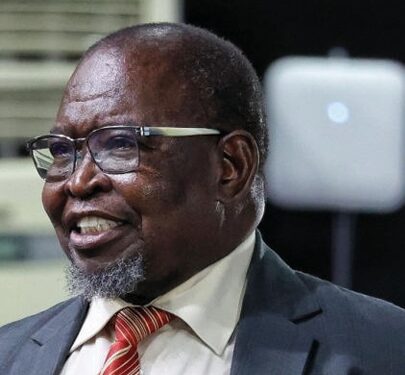

NKANGALA – Finance Minister Enoch Godongwana has confirmed that the Value-Added Tax (VAT) rate will remain at 15% from May 1,2025. This decision comes after consultations with political parties and feedback from parliamentary committees. Initially, the government had planned to increase VAT by 0.5%, but this was met with backlash from various political groups.

Thando Mahlangu, a street vendor at Phola Mall in Vezubuhle, shared his mixed feelings about the announcement with the Highveld Chronicle. “The paint we use for our Ndebele accessories increased in price in March. Recently, I had to pay double the amount just a day before the VAT increase was reversed,” he said. Mahlangu believes the minister should not be praised for the decision, claiming it was made under pressure from the EFF, DA, and MK, who took the matter to court. “Next time we vote, we should choose leaders who make decisions for the people and show concern for the poor,” he added.

The finance ministry has warned that keeping the VAT rate at 15% will lead to a revenue shortfall of around R75 billion over the next several years. To address this, Minister Godongwana announced he would withdraw the Appropriation Bill and the Division of Revenue Bill to make up for the loss.

The price of toiletries, including sanitary pads, was also expected to rise by 0.5%. Members of a ladies’ club in Tweefontein K voiced their concerns. Nombuso Packery said, “Pads should be VAT-free. The price of toiletries should be lower because we need to buy pads every month. Our government should make pads VAT-free since we use them for our natural needs. Many of us come from poor backgrounds, and the VAT on toiletries should be reduced.”

The EFF welcomed the decision but called for the immediate resignation of Minister Godongwana and Dr. Duncan Pieterse, Director-General of the National Treasury. “This entire budget fiasco should be a reflection that they are out of depth and pose a threat to the economic stability of the country,” the party said.

Godongwana is expected to introduce new versions of the Appropriation Bill and the Division of Revenue Bill soon.